Budgeting is important because, to be frank, money matters. Do you want that new game or a spring break trip? Well, you’re going need to know where your money is going, and the best way to do that is to make a budget. Budgets are not so much constraints, as they are guides for planning purchases and understanding your financial state.

Often small expenses add up to a surprising figure. A budget allows you form an accurate awareness of your expenses and create a plan for your month’s expenses.

We know budgeting can be kind of rough but here are some resources you can use:

The apps below are tools that can be used to help plan for large purchases, or just getting a better understanding of where all that money went this month.

Mint: Mint is an app that helps people budget and stick to their budgets. It can also keep track of bills like for your credit card or your phone; it’s available on IOS and Android.

ToshL Finance: is similar to Mint, but is a separate app. It is also available on IOS and Android.

Cicmoney101.org: This budget making sheet goes really in depth with expenses, so if you’re living off campus, this will help with housing expenses.

Left to Spend: This is an IOS and Android app that allows the user to set the amount of money they can spend and then shows them how much they have left to spend within their budget.

Understanding a Budget:

A Budget simply maps income and expenses.

Most often this is done on a monthly interval as this provides a consistent, yet accurate description of actual income in comparison to expenses.

Income can either be in the form of a regular paycheck or spontaneous sources such as gifts or sales.

Regular expenses are also best understood on a monthly basis as this helps you stay in line with your budget.

Savings Vs. Debt

If your income is greater than your expenses, the remainder becomes savings. Often people predetermine how much of their income they plan on saving.

If expenses are lower than that becomes additional savings.

If your income is less than expenses, that becomes debt. This can be ok in the short term but is not sustainable in the long terms.

Note: Accruing debt has a cost. Borrowed money has interest. That is a cost of borrowing money. In addition to repaying the amount borrowed an additional

interest payment is also charged. This is for any type of loan or use of credit (via credit cards etc.)

Your credit worthiness (credit score) determines the cost of borrowing money or interest. That is your demonstrated track record of repaying previous debt.

Income types to be accounted for:

| Yearly income | What you plan on making this year. This is how salaries are often described. Understanding yearly income helps determine long-term purchases and ability to use credit or debt. |

Ex. Student expects to make $1000 |

| Monthly Income | What you were paid this month. Used to compare to expenses on a monthly basis. This provides a more accurate picture of your financial state at the moment. Also, fixed expenses are often paid monthly. | Ex. Student made $300 this month from part-time job |

| Subtract Taxes | Account for income tax. [income- (tax rate x income)] = take home income |

Ex: Student’s income was taxed at 15% [$300 – (.15 x $300)] = $255 |

| Irregular income | One-time “gifts” or temporary income source. Can include gift money, the sale of old items, and tax returns, etc. |

Ex: Student gets $20 from grandma +Student sold textbooks for $100, =$120 irregular income |

| Total income | Regular income (after taxes) + irregular income | Ex: $255 + $120= 375$ of income this month |

Expenses to account for:

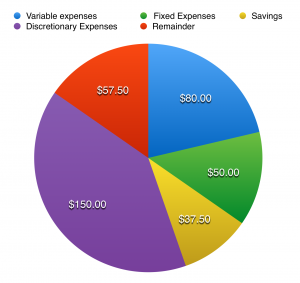

| Fixed expenses | Expenses that stay constant regardless of consumption(usually regular payments) | Ex. Rent, Cell Phone, Electricity, insurance payment, Netflix, other bills, etc.

Student spends $40 on phone + $10 on Netflix =$50 of fixed expenses. This does not change through the month. |

| Variable expenses | Expenses that change as you consume | Ex. Food, clothes, water, and gas, etc.

Student spends $50 on gas and $30 on groceries =$80 on variable expenses. This depends on how much you use. |

| Savings | Income set aside to save for the future | Ex. Money that is specifically set aside for large purchases, or emergencies

ex: student decides to save 10% of income each month. |

| Discretionary Income | Anything that you want that is not considered any of the above “necessary expenses” | Student has a discretionary budget $207.50 for anything deemed a “want.”

The student spends $150 of this budget on Amazon. The remainder inherently becomes savings. If expenses were greater than $207.50, the additional expenses would become debt. |

Emergencies:

Unexpected, necessary, expenses that could happen anytime. (illness, injury, transportation, etc.)

This could significantly effect your month’s budget, limiting the discretionary and variable expenses as well as savings.

Emergencies are, by nature, often costly and therefore demonstrates the importance of having a regular contribution to savings.

Having savings prevents or limits you from going into debt to pay for sudden emergency expenses.