The 1098-T is a tax form that shows how much was paid towards qualified tuition and related expenses in the previous tax year. All schools are required to report this information. The 1098-T form is informational only and should not be considered as tax advice.

By law, we are required to make the 1098-T available to students by January 31st. Current students can access the form online by following the instructions below. Former students are mailed a copy of their 1098-T to the permanent address they have listed on their account.

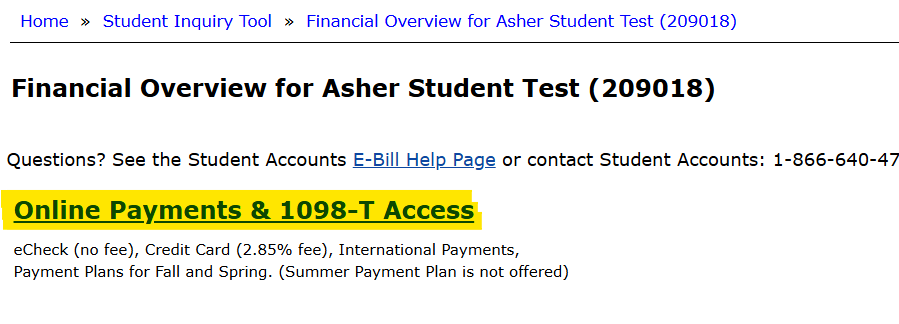

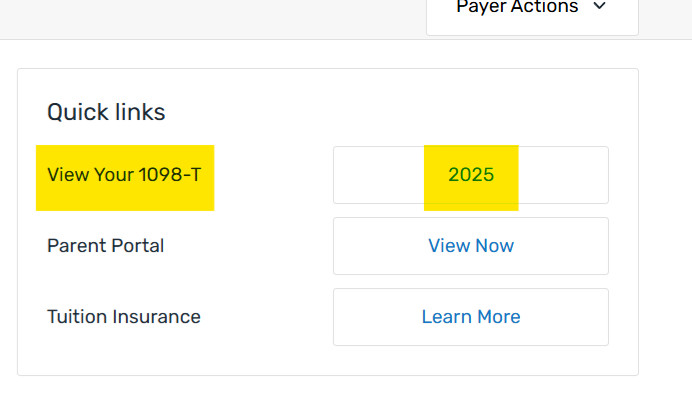

How to Access Your 1098-T

Frequently Asked Questions

Why didn’t I receive a 1098-T form?

- If you did not provide St. Olaf College with your Social Security (SSN) or Tax Identification Number (TIN), you should complete a W-9s form and send it the Student Account Office so we can send you the 1098-T.

- If you are an international student classified as a “Non Resident Alien” in St. Olaf’s student record database, you would not have received the 1098-T form.

- If your 1098-T form was sent to an old or incorrect address, you should provide your current mailing address to the Registrar’s Office so we can resend a 1098-T.

- If you had no payments towards Qualified Tuition and Related Expenses, you would not receive the 1098-T form.

Why is Box 1 filled in and Box 2 is blank?

Effective tax year 2018, the IRS required institutions to report the amount paid, in a calendar year, towards Qualified Tuition and Related Expenses instead of the amount billed.

Box 1 does not match my records of what I paid the school this year, why is that?

Payments reported in Box 1 would include out of pocket payments as well as loans and scholarships. It does not include payments that were made on the student’s account that were for non-tuition educational expenses such as Housing, Meal Plan, Health Insurance, as well as other fees.

For purposes of Box 5, what scholarships are included?

All grants and scholarships from St. Olaf College or an outside organization that were received and processed in 2023 are included on the 1098-T form. This may include outside scholarships that were designated for spring 2024, but received in 2023.

Does the 1098-T contain all the information I need?

While it is a good starting point, the 1098-T, as designed and regulated by the IRS, does not contain all of the information needed to claim a tax credit. To determine the amount of qualified tuition and fees paid, and the amount of scholarships and grants received, a taxpayer should use their own financial records. There is no IRS requirement that you must claim the tuition and fees deduction or an education credit. Claiming education tax benefits is a voluntary decision for those who may qualify.

Does the information on the 1098-T correlate to a specific amount I can claim on my tax return?

Unfortunately, no. In Box 1, St. Olaf College will report the amount paid in a given year towards Qualified Tuition and Related Expenses. This may include previous calendar year’s Qualified Tuition and Related Expenses that were paid in 2023. Box 1 also does not include other Qualified Tuition and Related Expenses related expenses that may be eligible for tax benefits such as books. Furthermore, any related qualified expenses for the American Opportunity Tax Credit need to be determined from records kept by the taxpayer. The College does not track these type of expenses on the 1098-T.

Box 5 of the 1098-T constitutes scholarships which are considered to be taxable income to the extent Box 5 exceeds the actual amounts PAID for tuition, books, required course fees, and required equipment. The taxpayer will need to figure the correct amount from their own records.

How does my study away affect the 1098-T form?

The IRS regulations requires St. Olaf College to report expenses that meet the strict Qualified Tuition and Related Expenses definition. Depending on the study away program, the program fees may cover expenses such as, room, meals, flights, excursions. These are not considered a qualified tuition and related expenses, so they are not included on the 1098-T form.

Will St. Olaf College employees be able to assist me with tax preparation questions regarding the 1098-T form?

St. Olaf College employees can help answer questions on the number(s) in box 1 and box 5, but cannot provide tax preparation guidance. Please consult a tax professional with questions regarding filing your taxes and incorporating the 1098-T form. More information is available on the IRS website.

You must be logged in to post a comment.