Please note that the IRS Data Retrieval Tool is currently down. It appears to be available within the FAFSA, but is not functional. Families will need to manually enter their 2015 financial information. If a student is selected for federal verification, they will need to request a Tax Return Transcript instead of utilizing the Data Retrieval Tool in the FAFSA. We have been told by the US Dept of Education that it will be up and running in October 2017.

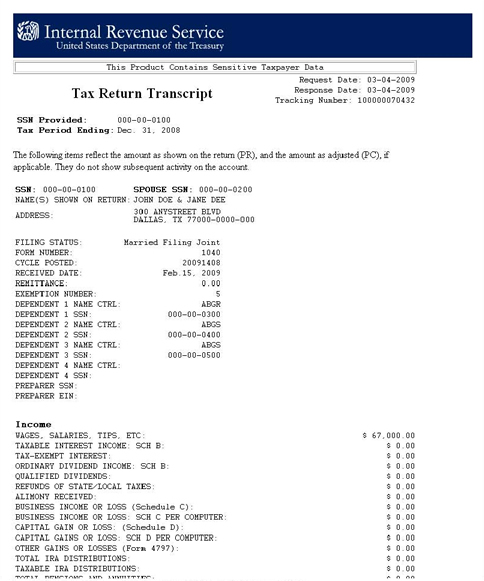

If a student or family is not eligible to complete the Federal Verification process through the IRS Data Retrieval tool, they must submit an IRS Tax Return Transcript to complete federal verification. The IRS Tax Return Transcript is different from the 1040 Tax Return. The Tax Return Transcript is a typed form that can only be completed by the IRS.

IRS Tax Return Transcripts can be requested online. Starting with the 2013 Tax Year, tax filers should be able to get their Tax Return Transcript instantly online from the IRS.

When submitting a tax return transcript, be sure to include every page. The transcripts are often double-sided. Please write the student’s name and student ID # or Social Security Number on the transcript before faxing or emailing the document to our office.

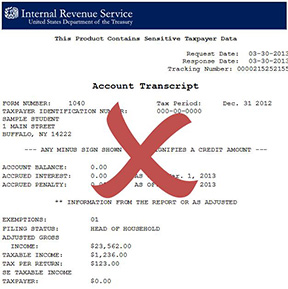

One important thing to note, when submitting the request for the transcript, select the Tax Return Transcript, not the Tax Account Transcript.

You must be logged in to post a comment.