HOW ENDOWED FUNDS WORK

-

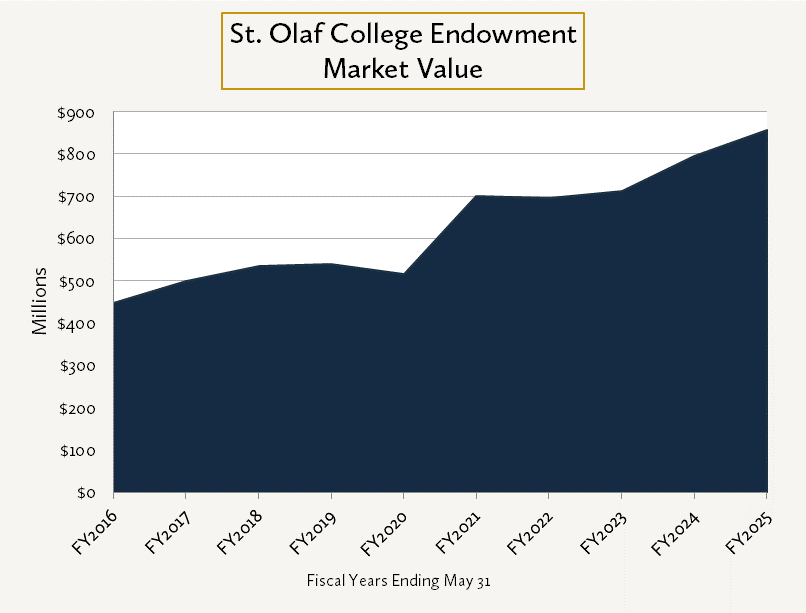

- The endowment consists of more than 2,193 individual funds invested and managed according to policies established by the Finance and Investment Committees of the Board of Regents, assisted by CornerStone Partners. Its primary goal is to secure long-term returns that meet or ideally exceed expenditures.

-

- Like a savings account, the fund focuses on building the value of the initial gift over time. Once the initial commitment is met, earnings become available for use. The rate is between 4.0% to 5.0% of the 16-quarter (four years) rolling average market value of all Endowment assets. This provides predictable income and reduces exposure to market volatility.

-

- A signed endowment agreement outlines our partnership and guides the college’s stewardship and use of your fund.

-

- Annually, the college provides donors who establish endowed funds with a financial report on their fund performance and the impact it provides Oles.

You must be logged in to post a comment.