Assisting Your Retirement Pre-65

Individuals, who are under age 65, have three options to consider for healthcare and related benefits.

Option 1: COBRA

HEALTH INSURANCE – TRADITIONAL

| Core Health Plan** | High Deductible Health Plan** | |

| Employee | $ 813.96 | $ 828.24 |

| Employee +1 | $ 1,670.76 | $ 1,639.14 |

| Family | $ 2,527.56 | $ 2,450.04 |

HEALTH INSURANCE – COUPE

| COUPE Core Health Plan** | COUPE High Deductible Health Plan** | |

| Employee | $ 837.42 | $ 788.46 |

| Employee +1 | $ 1,721.76 | $ 1,562.64 |

| Family | $ 2,607.12 | $ 2,335.80 |

**Early Retiree and COBRA rates combined due to phase-out of the Early Retiree Program as of 1/1/2018.

Vision

| COBRA | |

| Employee | $7.69 |

| Employee +1 | $11.16 |

| Family | $20.00 |

Dental

| COBRA | |

| Employee | $40.80 |

| Employee +1 | $74.46 |

| Family | $139.74 |

Basic Life INSURANCE

$0.081/$1000

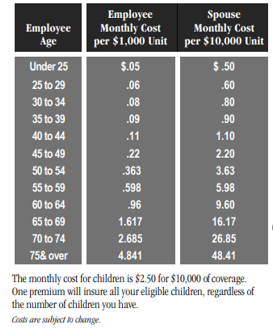

VOLUNTARY Life AND DEPENDENT LIFE insurance

Flexible Spending Accounts (FSA)

If you have a balance remaining in your Dependent Care FSA after your termination from employment, your participation in this benefit will be deemed to continue until you have “spent down” your Account or through the end of the Plan Year in which your termination occurred, whichever occurs first. You can submit Dependent Care Expenses incurred after the date of your

termination but before the end of that Plan Year. All other Plan requirements for

eligibility of Dependent Care Expenses, including that the expenses must be necessary for

you to work or to find work, must be satisfied.

Medical expenses incurred after the date of your termination from employment will not be eligible for reimbursement unless you elect to continue your participation in the Medical FSA. This includes Medical Expense Reimbursement and the Dependent Care Reimbursement.

Option 2: MNSure.org

MNSure is Minnesota’s health insurance marketplace where individuals and families can shop, compare and choose health insurance coverage that meets their needs.

Find Free Help Near You:

Option 3: Move to a Spouse’s Plan

Retirement is a qualifying life event that would allow you to move on to a spouse’s insurance plan. Be sure the plan has “creditable coverage” as defined by Centers for Medicare & Medicaid Services (CMS), if you are going to remain on your spouse’s plan after age 65.

Using Emeriti Retirement Healthcare Savings Plan (VEBA) for Reimbursement

Learn how it works:

click here

Submit qualified medical expenses using this form:

QME FOrm

You must be logged in to post a comment.