Title: Wells Fargo Commercial Card Expense Reporting (CCER) Out-of-Pocket (OOP) Expenses Procedures

Effective Date: 09-01-2012

Issuing Authority: Controller

Contact: Nate Engle at engle1@stolaf.edu or 507-786-3502

Last Updated: 09-17-2015

Purpose of Procedures

To provide information regarding the Wells Fargo CCER Out-of-Pocket expense reimbursement process.

Who needs to know these Procedures

These procedures apply to all St. Olaf faculty and staff who are seeking expense reimbursement.

Procedures

Wells Fargo Commercial Card Expense Reporting (CCER) Out-of-Pocket (OOP) Expenses

- If you do not already have access to the Wells Fargo CCER portal, please request access from the Accounts Payable Office. You do not need a commercial card in order to have access. If you have already set up your bank information in CCER, please proceed to Step 3.

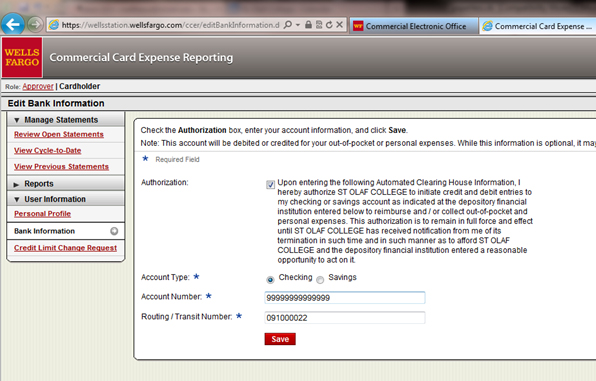

- When you log in to CCER for the first time, enter your bank information to begin using the out-of-pocket features. On the left side under “User Information”, click on “Bank Information”. After your bank information has been entered, you should be able to enter out-of-pocket expenses. However, there may be a slight delay. If it does not allow you to add an out-of-pocket expense immediately after entering your bank information, check back in a couple of hours.

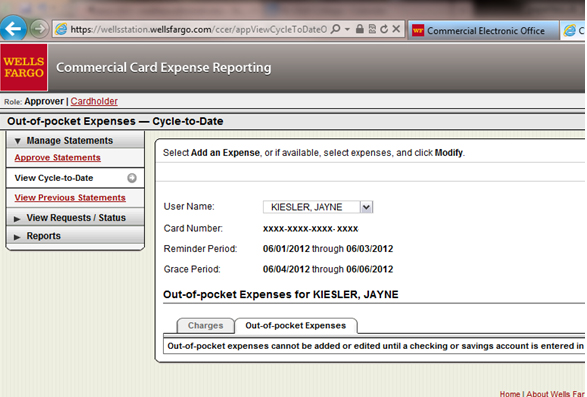

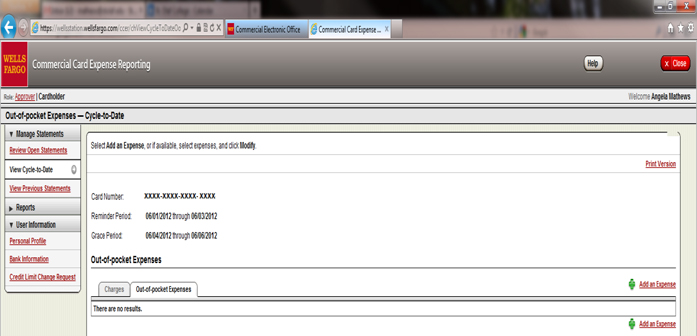

3. When logged into CCER, you will see an “Out-of-pocket Expenses” tab. You are able to enter expenses that need to be reimbursed (mileage, tips, etc.) on this tab.

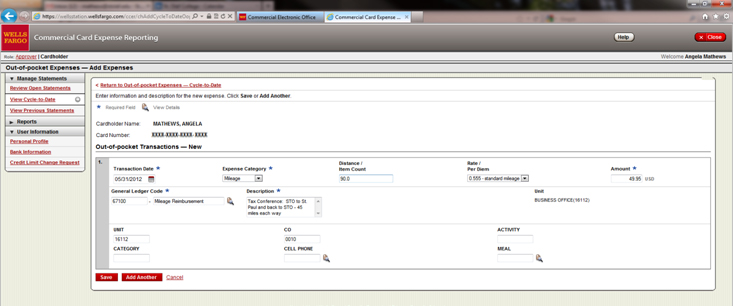

- Click “Add an Expense” to enter your out-of-pocket expense item.

5. The expense functions work very similar to the purchase card expenses. You can code the expense, add your description, and change your default unit as needed.

Things to note about the Out-of-Pocket Module:

- Expenses are reimbursed monthly into the employee’s bank account, right after the approver period ends.

- If the Approver declines the expense, it will not be reimbursed. The Approver should notify the cardholder if they decline an expense.

- The Approver is able to make corrections on the expense before approving (change amounts, coding, descriptions, etc.).

- If the Approver does not approve or decline the out-of-pocket charge, the charge will not be reimbursed that month, but remains open for approval the next month. If the charge is not approved by the time the Approver period ends, the out-of-pocket expense will remain in the “previous statement’s” section. After the next statement cut-off date, the outstanding out-of-pocket expense will show with the current month charges that are currently being reviewed and approved.

- The Out-of-Pocket items print out on your purchase card statement along with your credit card charges. Receipts or supporting documentation for out-of-pocket charges should be attached to your statement.