Title: Wells Fargo Commercial Card Expense Reporting (CCER) Personal Expense Repayment (PER) Procedures

Effective Date: 09-01-2015

Issuing Authority: Controller

Contact: Nate Engle at engle1@stolaf.edu or 507-786-3502

Last Updated: 09-01-2015

Purpose of Procedures

To provide information regarding the Wells Fargo Commercial Card Expense Reporting (CCER) Personal Expense Repayments (PER) that work in conjunction with the Wells Fargo purchase card.

Who needs to know these Procedures

These procedures apply to all St. Olaf faculty and staff who have a St. Olaf purchase card and find that they charged something on the card that should not be paid for by the College. Using the Personal Expense Repayment feature facilitates repayment to the College.

Procedures

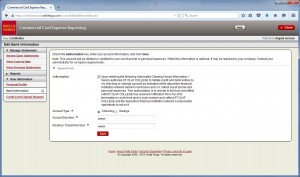

- When logged into CCER, navigate to “User Information” and then “Bank Information”.

Check the authorization box for St. Olaf College to make direct deposits and withdrawals on the account you specify. Input your account type, account number, and routing number (no withdrawals are made until you specifically identify the item and the amount during your monthly submission process). Save.

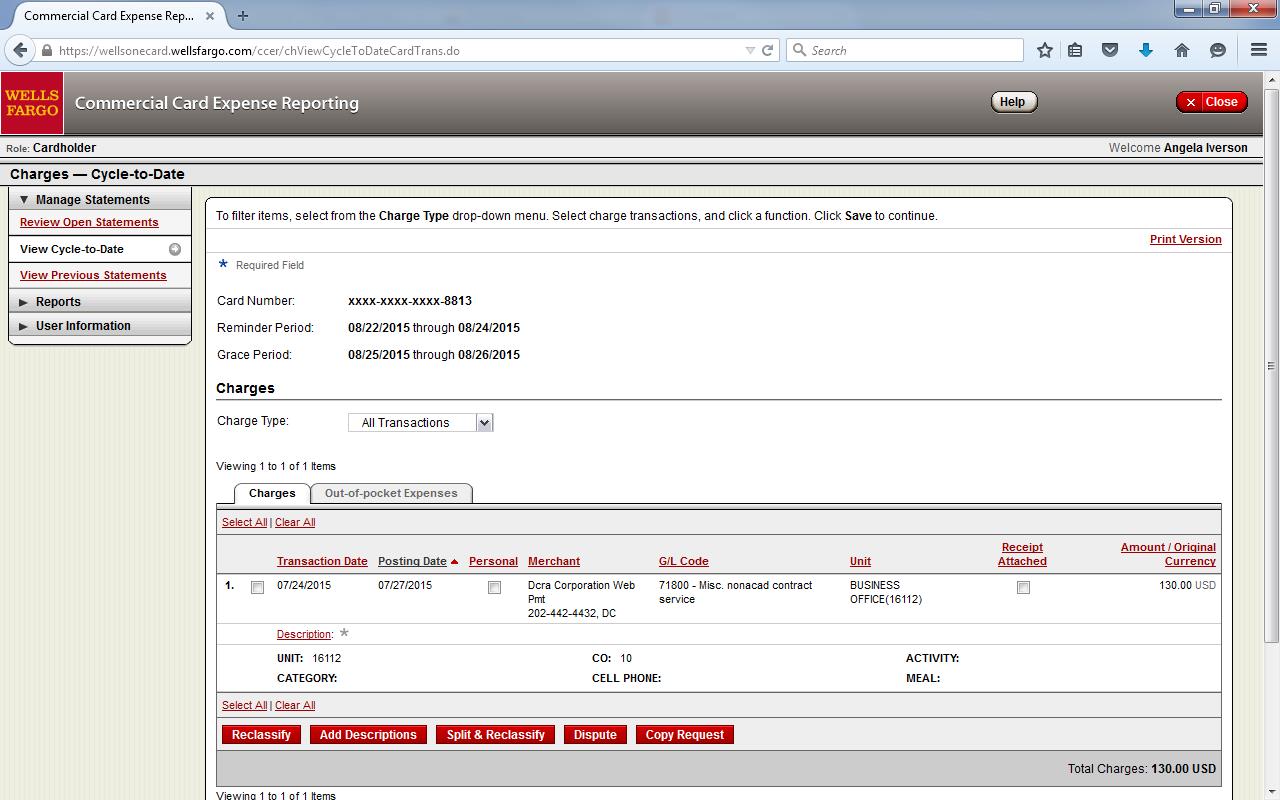

- Go to your coding screen by clicking on “View Cycle-to-Date” or “Review Open Statements” as you normally do each month. If the entire charge was accidentally made to the Commercial Card, check the box labeled “Personal” and the entire amount will be repaid to St. Olaf.

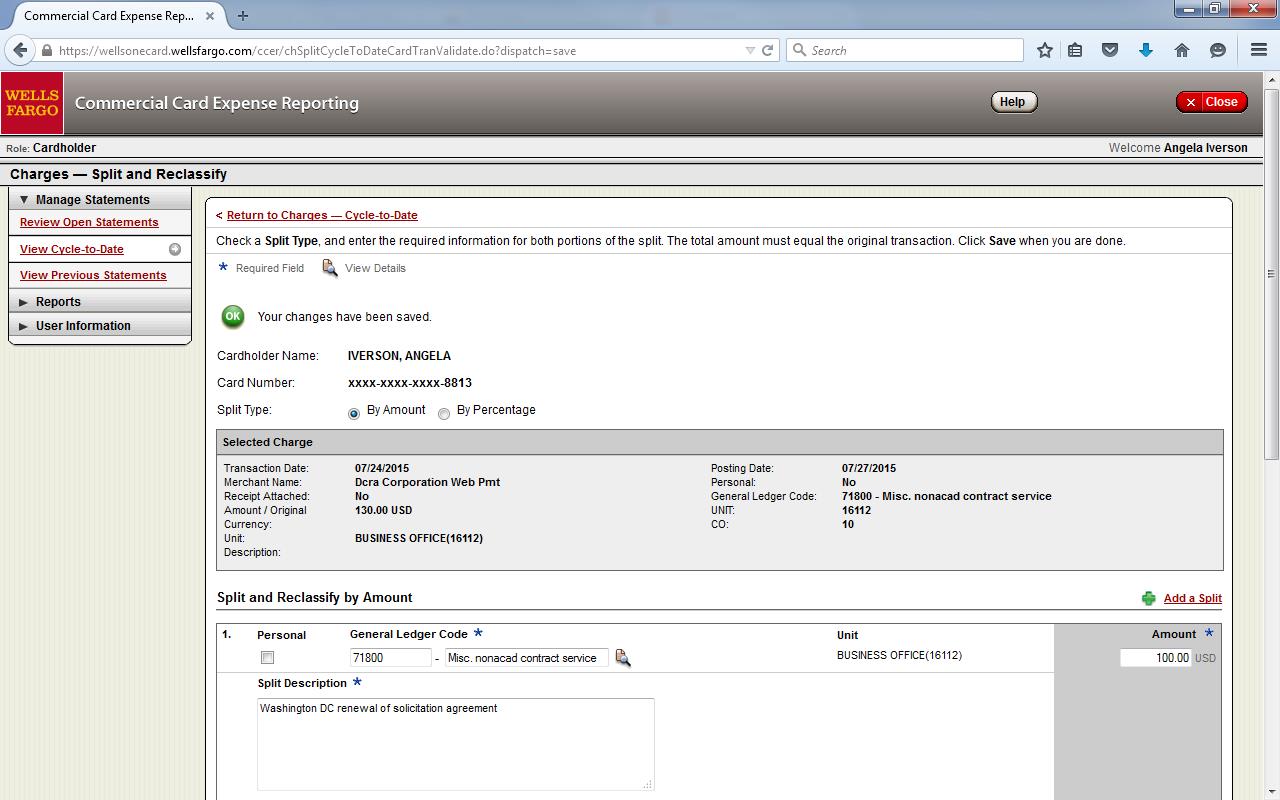

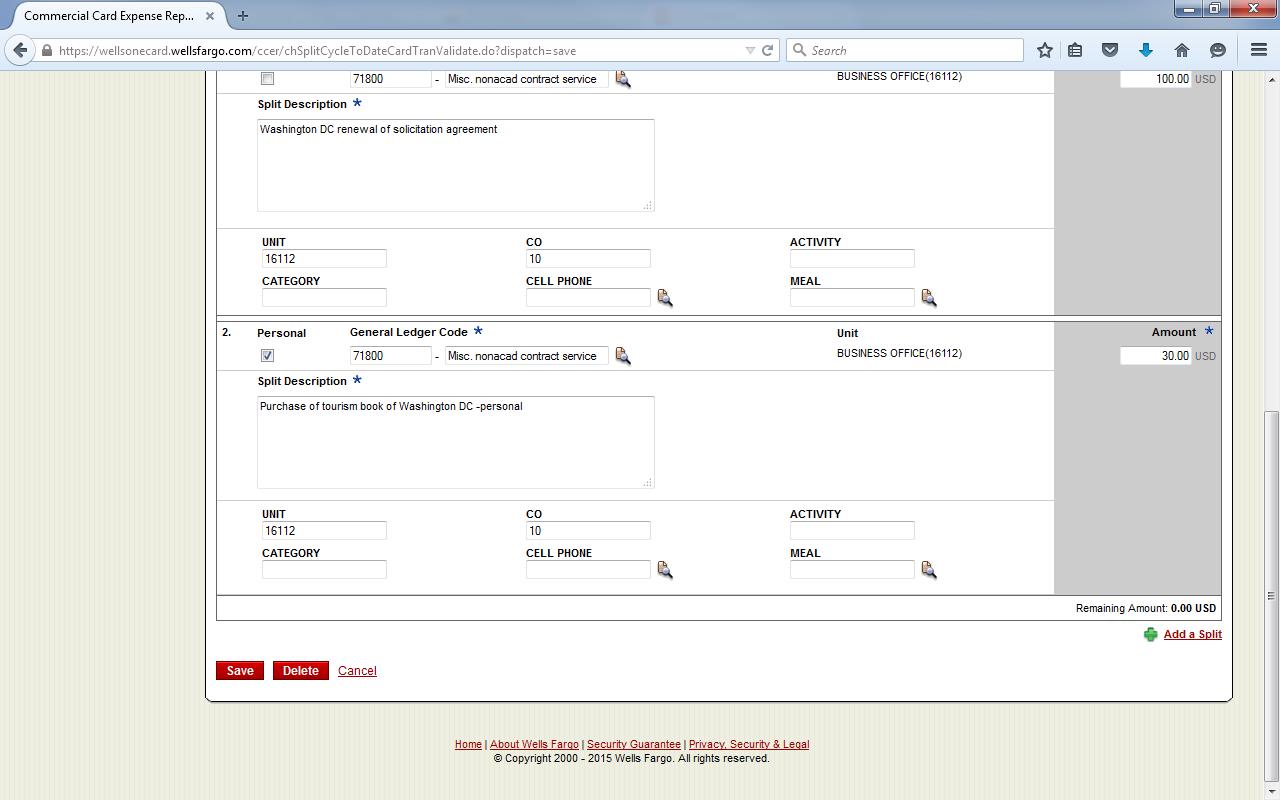

- If only a portion of the charge was personal, split it by selecting the charge and clicking the “Split & Reclassify” button. A screen will appear to allow input of the dollar amount for each purpose. Check the “Personal” box for the portion you wish to repay. You may choose any GL code for the personal items since the charge is offset with the repayment, netting it to zero.

- Save each split & reclassify as you go, and Save before exiting your session.

Notes regarding Personal Expenses Repayments using the CCER process:

- If the item purchased was something taxable or tippable, please allocate the appropriate amount of the total tax and tip from the charge to your personal purchase. Please show your breakdown of any split charge on the supporting documentation submitted with your statement as normal done. This allows the approver to easily determine where the numbers came from, and proves the correct treatment of charges to the auditors.

- Please remember that any charges denoted “Personal” will initiate a withdrawal from the bank account you specified. Do not check “Personal” and also remit a reimbursement payment to the Accounts Payable Office, as this will create a double payment for the charge.